Japanese banks utilise Ripples blockchain tech for payments app

- Thursday, March 8th, 2018

- Share this article:

A group of Japanese banks preparing to release a consumer payments smartphone app built on Ripple’s blockchain technology.

A group of Japanese banks preparing to release a consumer payments smartphone app built on Ripple’s blockchain technology.

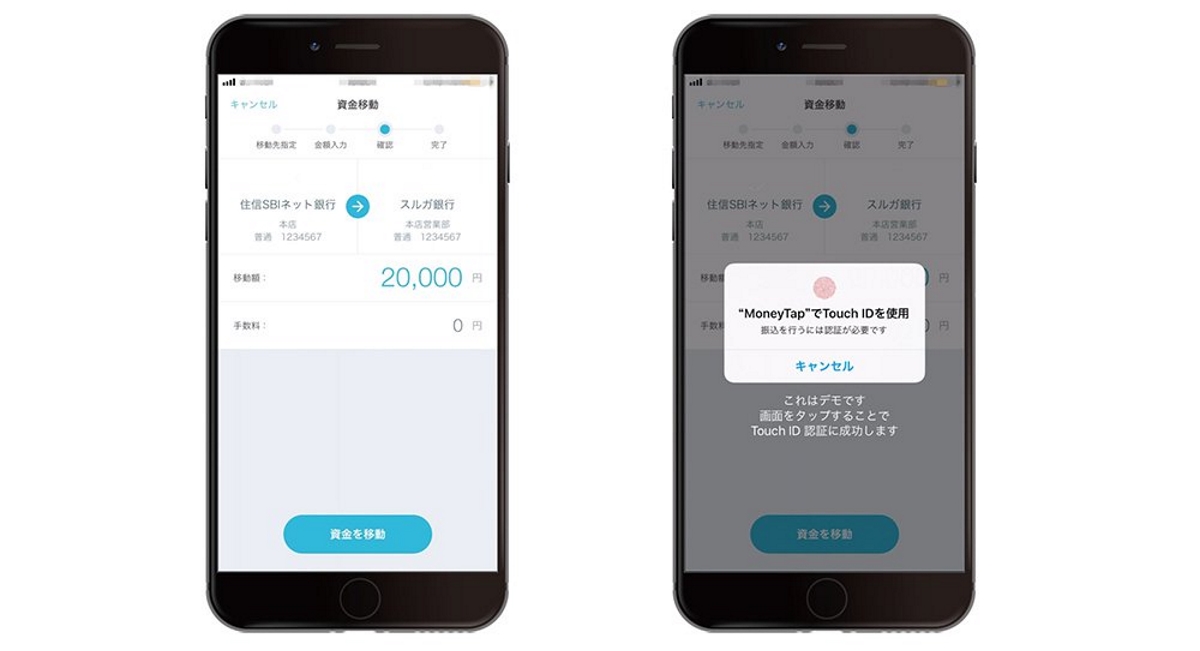

The app, which will be called MoneyTap, has been developed by the Japan Bank Consortium – which is led by SBI Ripple Asia and comprised of 61 banks. It will enable customers of the banks in the consortium to be able to settle payments through their mobile phones instantly at any time of day.

“We are proud to leverage Ripple’s blockchain technology through our new mobile app, MoneyTap, to improve the payments infrastructure in Japan,” said Takashi Okita, CEO of SBI Ripple Asia.

“Together with the trust, reliability and reach of the bank consortium, we can remove friction from payments and create a faster, safer, and more efficient domestic payments experience for our customers.”

To use MoneyTap, bank consortium customers will only require a bank account, phone number, or QR code. It will go live to SBI Net Sumishin Bank, Suruga Bank, and Resona Bank customers in the autumn of this year, before being rolled out to the rest of the consortium gradually.

“We’re proud to provide this production-ready technology that not only improves the international payments experience, but also have applications for domestic payments infrastructure,” said Emi Yoshikawa, director of joint venture partnerships at Ripple.