2019 Awards Preview: Most Effective Location Campaign

- Monday, October 14th, 2019

- Share this article:

Ahead of our 2019 Effective Mobile Marketing Awards, staged in partnership with our headline partner Dynata, and our partners DAX and TabMo, well be previewing the nominees in each category,giving you a glimpse at the high quality of entries weve seen this year. In today’s preview, we take a look at the top location campaigns.

BP & Uberall: Building a Local-Global Brand: BP and Uberall Deploy Pin-within-a-Pin Location Strategy

BP expanded its convenience partnerships – individually owned/operated convenience stores within petrol stations – by over 25 per cent in 2018 up to around 1,400 sites. This presented the company with questions around its location marketing strategy, so it needed a digital transformation.

The energy company enlisted Uberall’s location marketing cloud, which makes it possible for multi-location businesses, SMBs, local businesses or public institutions to automatically optimise their online presence, enabling them to reach the most relevant local prospects.

Uberall, with partner Geo-me, set out to achieve the goal of putting a pin within a pin for each of the BP locations that hosted a partner such as Wild Bean Café. They isolated each partner and tested the connection to top line directories (Apple Maps, Waze, etc.), testing marketing first in New Zealand before moving to the UK market. They then rolled the system out across South Africa, Netherlands and Australia. Wild Bean Café would now be a brand that had its own POI (place of interest) within the BP station — a pin-within-a-pin.

BP also had an issue with incorrect listings – with over 500 of its stations having erroneous coordinates. 23 per cent of stations were off by at least 50 metres and three per cent by over one kilometre. As such, BP also sought to take more control of dealer locations and roll out a more unified strategy for reputation management through Uberall.

In the past year, BP customers have asked for nearly 30m more directions from Google Maps. Requests for driving directions are up 21 per cent, action requests have grown 24 per cent, calls are up 42 per cent, website visits have increased 73 per cent, and overall impressions have climbed to 4bn.

Furthermore, BP’s review response rate is now over 70 per cent, with five-star reviews increased six per cent and reviews of two-stars and below decreasing four per cent in a six-month period. 85 per cent of all BP Google Maps reviews are three-star and above, with 50 per cent being five out of five.

Kier Living, Fonemedia, & Tank Top Media: Oakbrook – Snapshot Campaign

The business strategy behind the development and launch of this campaign was to increase awareness of the Oakbrook housing development in Marston Green, West Midlands with potential buyers, to drive inquiries and ultimately to result in sales.

Professionals who work within a commutable distance to Marston Green were pinpointed for the campaign and with Birmingham Airport just 2.4 miles from the development, workers there were the ideal group to target.

Fonemedia chose to ignore traditional marketing methods and use mobile to display an ad directly in the hands of people where they are most engaged in media. It used its Snapshot display ad format, which has geographic and demographic targeting capabilities, to target the mobile devices of people that met the criteria expected of a potential property buyer for this development. The format targets the device user rather than specific webpages or apps.

This campaign resulted in 47,523 impressions, 1,939 total clicks and a 4.08 per cent click through rate. It also achieved 59 conversions and a 3.04 per cent conversion rate. There were eight sales directly attributed to the campaign.

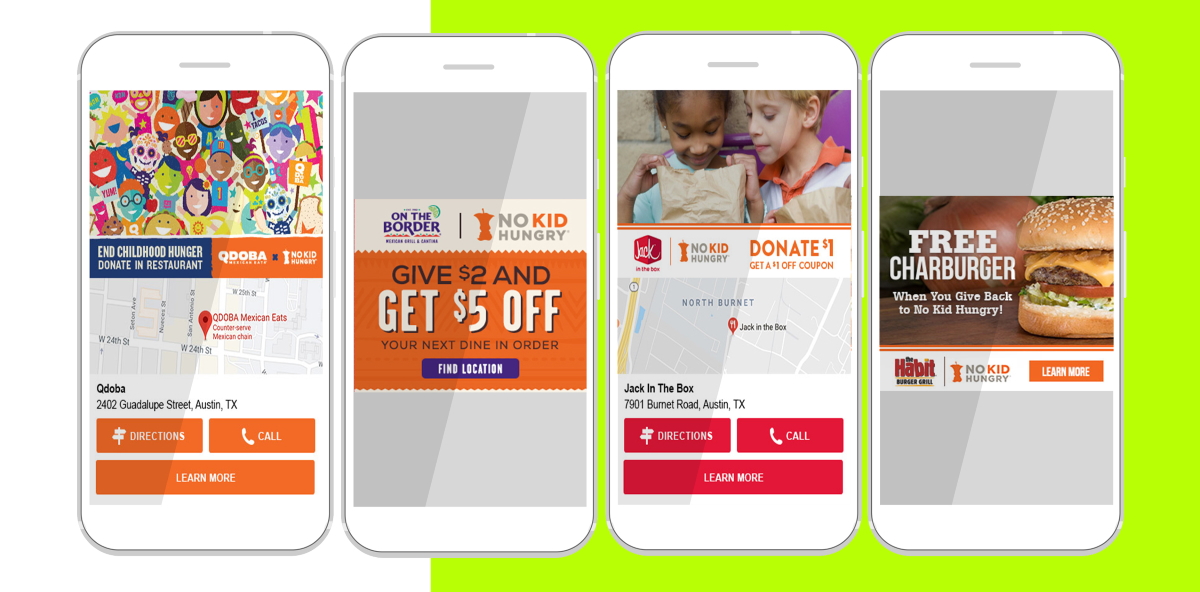

No Kid Hungry & GroundTruth: Dine Out for No Kid Hungry

With one in six kids facing hunger in the US, No Kid Hungry removes the barriers that stand between a child and the healthy food they need. GroundTruth partnered with the non-profit through its pro-bono ‘Location for Good’ initiative to drive measurable visits to each of the four participating national restaurant chains: Habit Burger, Jack in the Box, On The Border, and Qdoba.

Historically, Dine Out for No Kid Hungry would drive potential customers to its No Kid Hungry Map, which highlights the promotions of its partners and lists the locations of all participating restaurants, alongside a national public relations campaign. However, this approach wasn’t tailored to specific audiences and promotions were not always shown to people at times when they could donate or dine at one of the participating restaurants. So, GroundTruth designed a mobile campaign with each restaurant to reach audiences based on the specific needs of each brand.

GroundTruth utilised its knowledge of the quick service restaurants (QSR) industry, using inspiration from past campaigns with Outback, Taco Bell and Denny’s, to determine the best strategy. It decided the most effective solution was to connect with brand loyalists, and identified groups of individuals who would be receptive to visiting the participating restaurants, serving them mobile ads as they were out and/or when they were in proximity to a participating restaurant.

The location technology company used a combination of location targeting, audience targeting, and neighbourhood targeting across the four restaurant chains to reach likely customers.

The month-long campaign generated 129,000 visits, which helped to contribute to the $1.3m raised by the four participating restaurants. The location audience strategy performed best with a 0.31 per cent click through rate and a 3.56 per cent secondary action rate that includes clicks for directions or more information, which is higher than the 2.5-3 per cent industry benchmark. Within one month of location marketing, GroundTruth’s campaign had a 0.86 per cent visitation rate which is three times higher than the 0.20 per cent standard for QSR clients.

Royal Caribbean, Blis, & Mindshare UK: Royal Caribbean Wave Campaign

Royal Caribbean International’s (RCI) ‘Wave’ campaign was created to raise awareness of the company’s biggest sale of the year, and to increase brand awareness and purchase intent.

Blis was brought in by Mindshare UK to support the campaign by helping to amplify RCI‘s out of home (OOH) strategy and drive purchase intent. The campaign ran between 5 January 2019 and 31 March 2019.

The strategy for the campaign was to utilise Blis’ location data to profile devices exposed to RCI’s OOH advertising. Blis would then retarget those users identified as being exposed to the OOH campaign with engaging and contextually relevant creative to drive mobile engagements.

Blis used its audience targeting product to identify mobile that had been exposed to the RCI OOH spot by serving standard display ads to users within a 10-metre proximity of these locations, creating a custom audience group for targeting. These people were then retargeted when they were seen connected to their home or work wi-fi.

The real-world intelligence firm then partnered with On Device Research to conduct a brand survey study to measure brand uplift, brand awareness, and purchase intent.

The campaign achieved 3.8m impressions, with the standard banner having a click through rate of 0.77 per cent, which was 22 per cent higher than the benchmark. Video completion rate and engagement rate were 55 per cent and 35 per cent respectively.

Consideration for RCI was significantly increased overall with a +12 point increase, while purchase intent saw a +21 point increase. RCI’s purchase intent was higher than any of its main competitors in the survey.

Ryanair & Swrve: Localising Real-time Relevance to Increase Customer Loyalty

With over 55 per cent of its digital traffic coming from mobile devices, Ryanair turned to Swrve to improve its connectivity, increase mobile revenue, and elevate customer experiences and satisfaction with the brand.

As part of their ‘Always Getting Better’ campaign, the Ryanair team wanted an effective way to measure their customers’ satisfaction with overall experience, boarding, crew friendliness, service onboard and range of food and drink and more, as well as increase app ratings.

With Swrve, Ryanair created geofence-triggered customer satisfaction campaigns that delivered a simple star-based survey at all destination airports. Doing this enabled them to track customer satisfaction and increase app ratings and reviews.

Ryanair set Swrve up to take information direct from customers’ boarding passes, enabling Swrve to create a geofence around their destination airports. Once this geofence is left, a personalised survey notification is triggered. This notification still pops up even without cellular or roaming access because Swrve caches the entire interaction on the user’s device before departure.

Within three months of deploying the customer satisfaction campaign, over 300,000 passengers took part in the in-app survey. There was a 42 per cent engagement rate with the personalised push notification, with 71 per cent of those users going on to complete the in-pp survey, compared to less than one per cent engagement rates when sent via email.

Starbucks, Factual, Mindshare, & Xaxis: Foot Traffic for Frappuccinos

Starbucks wanted to build aware of its four new Frappuccino flavours across the Philippines while measuring in-store visits in the northern region of the country (Luzon). Starbucks enlisted the help of Mindshare, Xaxis and Factual to successfully reach and engage audiences, with the ultimate goal of getting people in stores.

The team used location data to target users in real-time and based on key personas, through Factual, alongside other third-party data providers. They then leveraged Factual measurement to measure the real-world impact of their digital efforts.

Starbucks ran campaigns across all addressable online media, with mobile playing a crucial role. It worked with Xaxis to combine contextual and interest-based targeting with location-based targeting, and with Factual to build highly-customised geofences around Starbucks outlets, competitors, universities, and office buildings. Factual’s audience product was also used to retarget people who had previously been to Starbucks and competitors’ stores, and to create a custom targeting segment that identified students, working professionals, and foodies. Finally, Factual’s measurement product was used to filter and measure validated footfall traffic at each previously designated location, and DSPs attributed footfall conversions to media exposure.

83,404 people, from 3.4m impressions, were successfully driven to Starbucks locations in the Philippines over the course of the campaign – that’s a store visitation rate of 2.5 per cent. Starbucks also saw 18,505 post-campaign conversions, which were measured seven days after the end of the campaign.

Factual’s audience product generated a cost per visit (CPV) of $0.09, while the proximity product came in with a CPV of $0.14. Overall, the mobile aspect of the campaign drove the highest volume of traffic, with in-app coming out on top with 50 per cent of overall conversions.

Volvo, Mobsta, Mindshare & Finecast – Volvo XC60 Human Innovations Campaign

This campaign aimed to reignite interest in the Volvo XC60, which was starting to fall short of orders, showcasing its award-winning features with video to encourage people to want to experience the car themselves. A key facet of the campaign was to understand the effect it had on driving the target audience into dealerships was the primary KPI.

Volvo partnered with Mobsta to use the company’s location-derived audience data to build a segment of auto-intenders at a post code level. Audiences that had been exposed to a TV ad for the car were also retargeted with display ads, within an optimum 30 mins/5-mile drive time to dealerships.

The overall campaign effect was then measured using Mobsta’s proprietary data and an exposed and control methodology at the device level – the first time this data had been used to buy against and measure a TV campaign. To do so, Mobsta’s data scientists had to devise a new methodology using machine learning to handle the volume of data a highly targeted national TV campaign produces.

Footfall volumes were compared across two time periods: pre-campaign (90 days previous) and post-campaign (from campaign start to 30 days post), using density-based cluster analysis to identify catchment areas and assign impression delivery to each dealership, in order to measure relative exposure to the campaign.

Mobsta was able to report results for each delivered media channel – linear TV and addressable TV – at a regional level and mobile media at a dealership level. This methodology gives Volvo actionable insights for future campaigns, as it has a better understanding of which regions performed best, thus identifying areas requiring greater focus or the need for alternative channels. Overall, the campaign drove an uplift of more than 30 per cent in dealership visits across all channels.

The Effective Mobile Marketing Awards Ceremony takes place in London on 14 November. To book your place at this celebration of the best in mobile marketing, click here.