Buoyant 2018 Marcoms M&A activity continues into 2019

- Monday, January 21st, 2019

- Share this article:

Marcoms sector M&A activity continues to surge at the start of 2019 off the back of high growth in 2018. That’s the conclusion of Results International’s assessment of the first few weeks of the new year.

Marcoms sector M&A activity continues to surge at the start of 2019 off the back of high growth in 2018. That’s the conclusion of Results International’s assessment of the first few weeks of the new year.

The high deal activity in 2018 was driven by the continued emergence of new buyers and private equity interest in the sector, as well as the continued requirement for in-demand skills in area such as technology, programmatic, content and analytics, the company says.

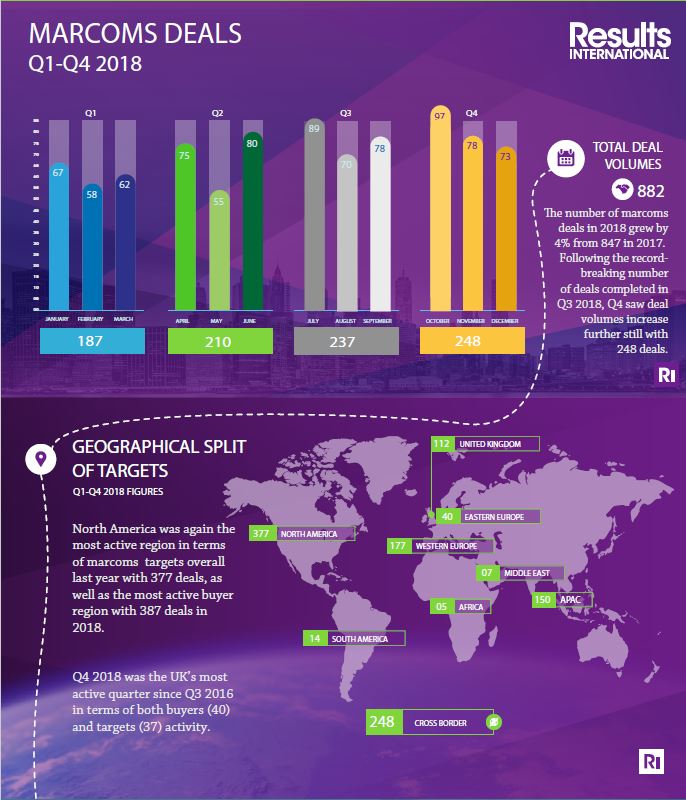

Despite being a transition year for holding companies and a lower pace of acquisitions by consultancies, the number of marcoms deals completed in 2018 grew to 881, a 4 per cent increase on 2017. The number of deals hit a two-year high in Q3 2018, only to increase further still in the final quarter, with 248 deals in total.

N. America was again the most active region in terms of marcoms targets overall last year with 377 deals completed, as well as the most active buyer region with 387 deals. The UK had its most active quarter since Q3 2016 both in terms of number of buyers (40) and target location (37).

Full service digital was the most active marcoms subsector in 2018 with 126 deals, followed by integrated (72) and website UX and build (71). This ranking confirms the attractiveness of integrated offerings with a full-funnel proposition and the ability to build and activate experiences at scale.

Media was the fifth most active sector in 2018 with 65 deals globally, a 20 per cent increase on the previous year. This was driven by Out Of Home acquisitions, such as the takeover of APN Outdoor Group by JCDecaux and the Adshel Street purchase of oOh! media. And also, by programmatic media buying such as S4 Capital’s second acquisition MightyHive.

“The MightyHive deal adds another leg to S4 Capital after securing content capabilities through the Mediamonks acquisition in Q3,” said Results partner, Julie Langley. “What’s worth noting is it highlights the significance of in-house offerings. “This trend could be viewed as an effort to better compete with consulting firms that are used to on-premises work. It could equally be seen as a reaction to brands increasingly taking certain functions in-house: this strategy is also apparent in the majority stake taken in Inside Ideas Group, home to in-house agency Oliver, by You & Mr Jones earlier this month.”

Additionally in Q4, the number of deals involving content agencies more than doubled over the previous quarter. This included US-based advertising and creative agency Eleven Inc being acquired by Vision 7 Communications (part of Bluefocus Communication), while Cognizant bought content agency Mustache and IPG agency Golin purchased Hurrah Production, a creative content studio based in Singapore.

The single biggest deal in Q4 was Quad/Graphic, a listed US printing and marketing services company, which bought the (also listed) printing and publishing services company LSC Communications for $1.4bn. The deal consolidates two of the largest US printing and publishing companies and followed a smaller domestic acquisition by Quad/Graphic in November with the takeover of marketing agency Periscope in November for $132 million. If the former deal is a pure volume play, the latter illustrates the need for outsourcing/execution companies to grow vertically in order to strengthen higher margin offerings such as brand building and media planning.

Almost a quarter (22 per cent) of all marcoms deals completed globally in 2018 were private equity-backed, representing a 79 per cent increase from 2017. There were 53 PE-backed deals in Q4 2018 alone, which represents the highest overall quarterly activity seen for several years.

A noteworthy PE deal in the previous quarter was US Aquiline Capital backed Output Services Group, acquiring UK-listed integrated marketing services company Communisis plc for $273m at a share premium of 39.8 per cent.

On this, Langley comments: “Between private equity’s growing interest in the sector and the heavy costs related to being a listed entity, it wouldn’t be at all surprising to see more public-to-private transactions among small & mid-cap companies. The high premiums paid in the process, such as in the case of Communisis, constitute an attractive option.”

The most active buyer in 2018 was Dentsu with 31 deals. It was followed by WPP, which only acquired 15 marcoms companies – a 50 per cent drop from the previous year and a direct consequence of the ongoing group restructuring.

Accenture retained its third position in the list of most active buyers, with nine deals in 2018. These included the purchase of Swedish data-driven marketing group Kaplan in November. The acquisition of Kaplan was followed by the acquisition of programmatic adtech company Adaptly in December, confirming Accenture’s foray into media after the launch of its programmatic unit in May 2018.

Consultancies overall accounted for 23 of the marcoms deals this year, 12 of which took place in Q4. Accenture completed 39 per cent of all consultancy deals in 2018, followed by Capgemini and E&Y, which each acquired three marcoms companies.

Despite the prevailing macroeconomic headwinds affecting a wide range of sectors, we anticipate a busy 2019 given that deal activity shows no signs of slowing and consulting firms seem set to resume acquiring digital marketing capabilities.

There’s an infographic summarising all this activity available for download here.