Money management app downloads soar by 46 percent as inflation bites

- Wednesday, June 22nd, 2022

- Share this article:

Savings-conscious UK consumers downloaded six million money management apps in the first six months of this year, says new research by app analytics platform App Radar.

Savings-conscious UK consumers downloaded six million money management apps in the first six months of this year, says new research by app analytics platform App Radar.

This was a 46 percent increase on the same period in 2021. And the report concluded that the spike was driven by the cost of living crisis in which UK inflation hit a 40-year high of 9 percent in April.

But the above number was just for Android. Taking into account potential iOS users, App Radar estimates total lifetime downloads for the sector could be around 78 million – or 10 percent of Europeans.

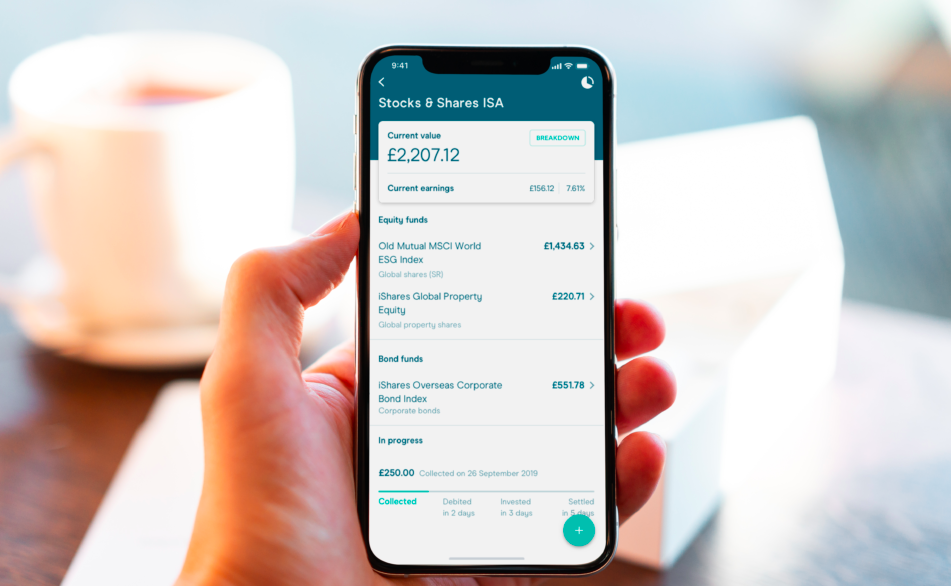

The fastest growing apps in the banking area were: Revolut with 3.8m new users, Monzo (584k) and the recently launched Chase UK (401k). In the savings and budgeting area, Plum (131k), Snoop (122k) and Moneybox (72k) added the most users, while in the deal comparison sector, Money Supermarket (75k), Confused (44k) and Raisin (14k) led the pack.

Silvio Peruci, Managing Director at App Radar, said: “While consumers cannot control inflation and rising prices, they can control how they spend money. Thankfully, innovation in the money management sector is ripe, especially ever since the introduction of Open Banking in 2018. It has never been easier to track your expenses, budget and compare deals. While this is not a solution to the cost of living crisis, it can provide some much-needed help.”