The mobile app economy is worth over $500bn, two thirds driven by advertising – report

- Thursday, May 18th, 2023

- Share this article:

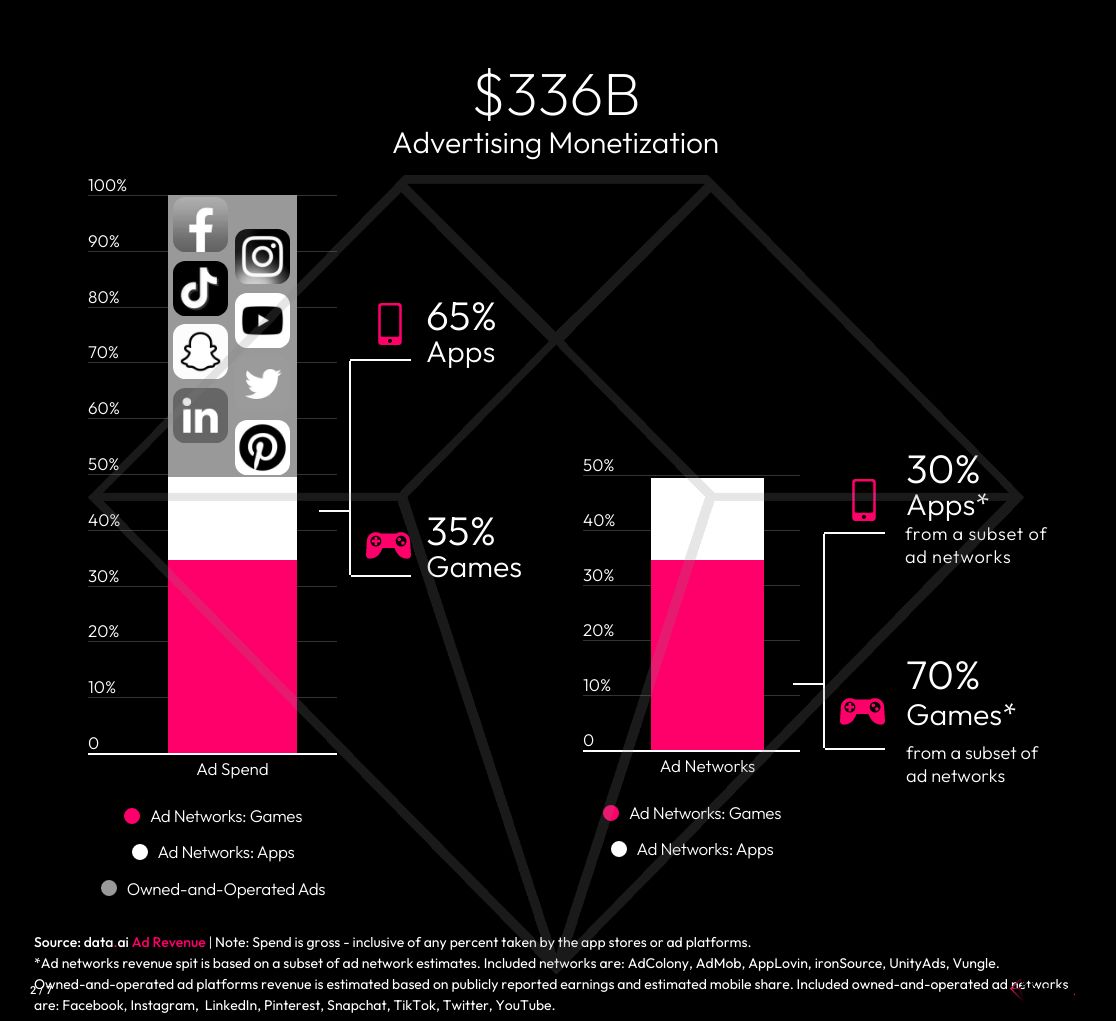

data.ai’s latest State of Mobile Revenue 2023 report reveals that the app economy is worth around $500bn ($401bn). Advertising accounts for $336bn (67 per cent) of this figure, with in-app purchases making up the remaining $167bn (33 per cent). Roughly 65 per cent of ad revenues come from non-game apps, with games accounting for the remaining 35 per cent. When looked at through the lens of in-app purchases, the figures are reversed, with games accounting for 66 per cent of the revenues, and non-game apps the remaining 34 per cent.

data.ai’s latest State of Mobile Revenue 2023 report reveals that the app economy is worth around $500bn ($401bn). Advertising accounts for $336bn (67 per cent) of this figure, with in-app purchases making up the remaining $167bn (33 per cent). Roughly 65 per cent of ad revenues come from non-game apps, with games accounting for the remaining 35 per cent. When looked at through the lens of in-app purchases, the figures are reversed, with games accounting for 66 per cent of the revenues, and non-game apps the remaining 34 per cent.

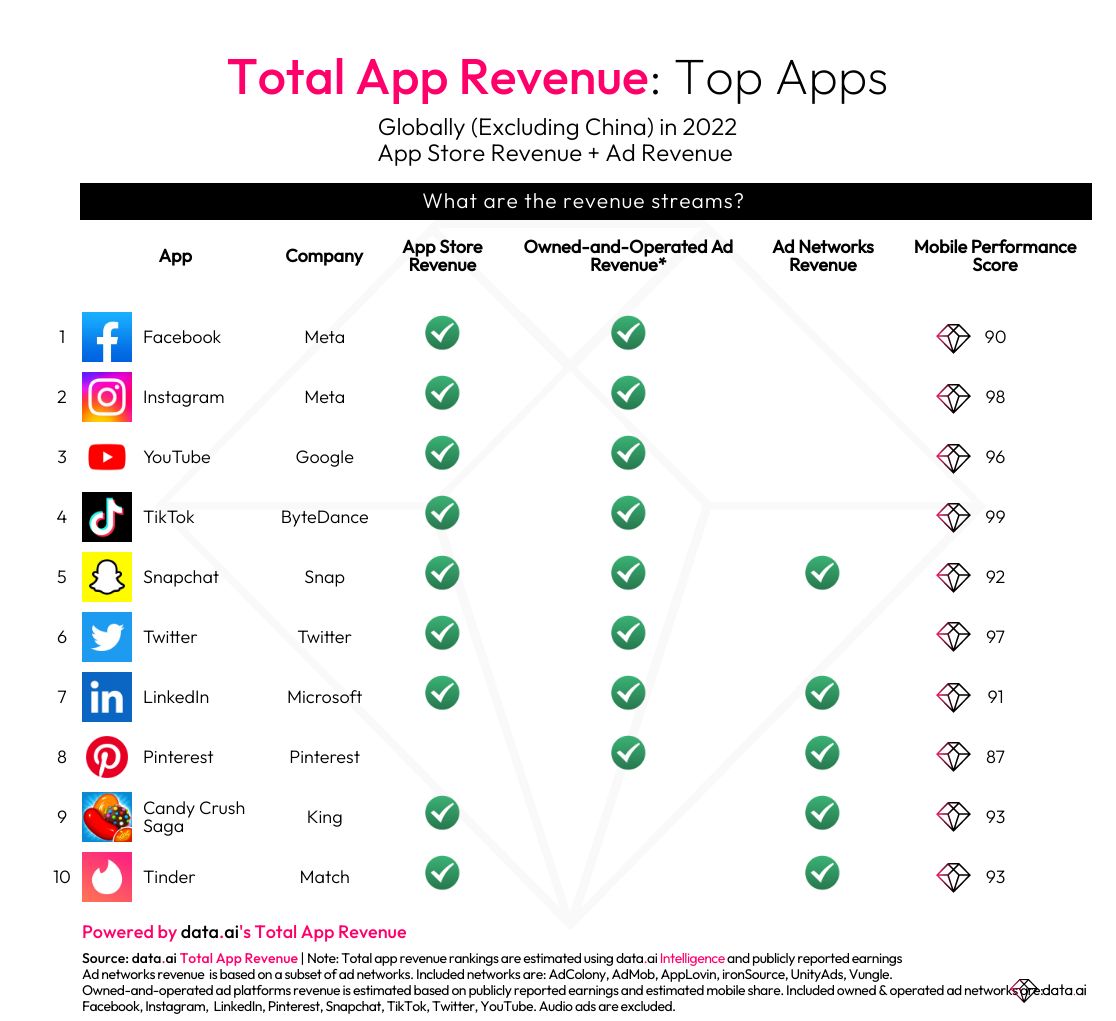

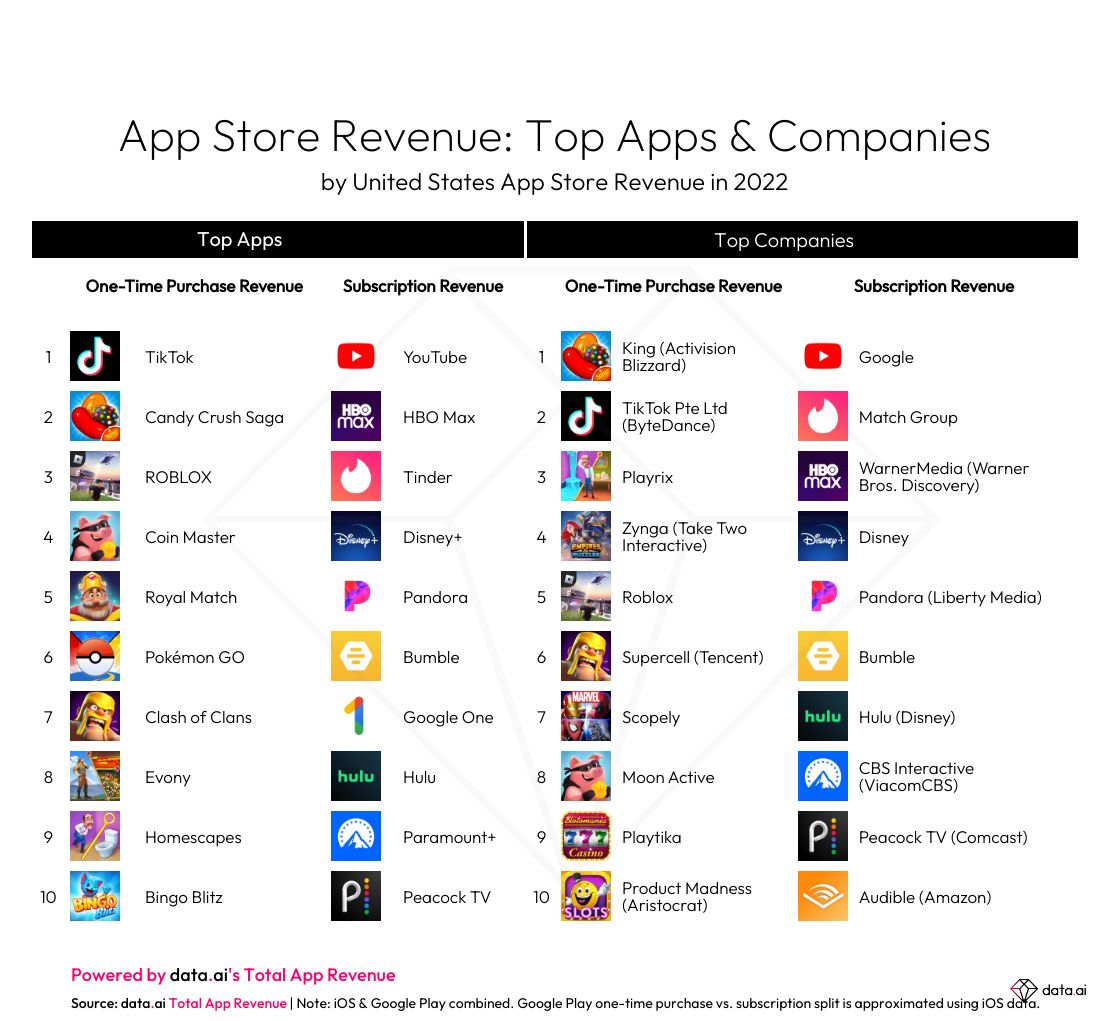

From a regional perspective, North America (46 per cent), Asia (23 per cent) and Europe (19 per cent), account for 88 per cent of mobile ad revenues. The top five genres of app for ad revenue generation are all games, with Hypercasual games leading the way, followed by Puzzle, Simulation, Tabletop and Match games. The top 5 apps in terms of app store revenues are TikTok, Candy Crush Saga, Roblox, Coin Master and Royal Match for one-off purchase revenues. For subscription revenues, the top 5 are YouTube, HBO Max, Tinder, Disney+ and Pandora. When it comes to total revenues, the top five apps are all social, with Facebook topping the rankings, followed by Instagram, YouTube, TikTok and Snapchat. These rankings are based on global revenues, excluding China.

Mobile advertising spend is not only a bigger chunk of the total revenue; it also grew much faster, at 14 per cent year-on-year in 2022 despite the challenges posed by the General Data Protection Regulation (GDPR) in Europe, and Apple’s introduction of its App Tracking Transparency framework, which reduced the size of the addressable audience available to mobile advertisers on iOS. Conversely, app store consumer spend decreased by 2 per cent year-on-year in 2022, as consumers budgets tightened amid concerns over inflation and the cost of living.

Mobile advertising spend is not only a bigger chunk of the total revenue; it also grew much faster, at 14 per cent year-on-year in 2022 despite the challenges posed by the General Data Protection Regulation (GDPR) in Europe, and Apple’s introduction of its App Tracking Transparency framework, which reduced the size of the addressable audience available to mobile advertisers on iOS. Conversely, app store consumer spend decreased by 2 per cent year-on-year in 2022, as consumers budgets tightened amid concerns over inflation and the cost of living.

To maximize mobile monetization dollars, market leaders leverage a combination of advertising, one-time in-app purchases and subscriptions as a hybrid model to diversify revenue streams. However, until recently, brands and publishers have been unable to benchmark total revenue on mobile or view their competition’s monetization strategies, hampering their ability to maximize their monetization mix.

This is now possible, however. data.ai has combined its Ad Revenue and In-App Purchase product offerings to deliver the ultimate mobile metric – Total App Revenue. data.ai customers can now break down all revenue streams to anticipate monetization opportunities based on shifts in consumer behaviour, ad network performance and Revenue Per Thousand Impressions (RPM) variation. Visibility into strategic metrics such as Average Ad Revenue Per User (AARPU) and Lifetime Value (LTV), is game-changing for competitors and market leaders to improve top-line business performance.

“Total App Revenue provides a clear picture of data we’ve been missing in our business development and model creation,” said Carlos Salvado, Senior Market Analyst at Rovio Entertainment. “With data.ai, we finally have a way to understand our full revenue streams and benchmark against competitors.”

Here are some of the other key findings from the report…

Total App Revenue: 65 per cent of the top 20 apps, including TikTok, Instagram, Snap, Twitter, Facebook, and LinkedIn use both in-app purchase and advertising revenue streams. Top games such as Candy Crush Saga and PUBG Mobile, alongside streaming apps including YouTube and Disney+, also use a mixed monetization strategy. On YouTube, while about 90 per cent of revenue comes from advertising, 10 per cent comes from app store purchases to remove these ads.

Total App Revenue: 65 per cent of the top 20 apps, including TikTok, Instagram, Snap, Twitter, Facebook, and LinkedIn use both in-app purchase and advertising revenue streams. Top games such as Candy Crush Saga and PUBG Mobile, alongside streaming apps including YouTube and Disney+, also use a mixed monetization strategy. On YouTube, while about 90 per cent of revenue comes from advertising, 10 per cent comes from app store purchases to remove these ads.

One-Time In-App Purchases (IAP): One-time-purchase models are gaining mainstream traction outside of games, largely popularized by TikTok’s creator economy model. This was followed by IAP microtransactions in gaming favorites Candy Crush Saga and ROBLOX.

Subscription In-App Purchases: Entertainment apps still command the share of wallet in the US for mobile subscriptions, with YouTube, HBO Max, and Tinder claiming the top three spots.

To get the full picture about the state of app revenues in 2023, download your copy of the report here.