The state of mobile digital experiences

- Tuesday, March 28th, 2023

- Share this article:

Andrew Fairbank, VP of EMEA at FullStory, looks at consumer expectations from in-app experiences, and explains how data can help brands better meet them.

Consumers have been leaning towards their mobile devices for several years. For example, The Guardian newspaper reported that UK online shopping on mobiles had overtaken web in 2014. But while brands have been aware of the mobile opportunity for some time (ads targeting mobile devices have been climbing to the current level of 48 per cent of digital advertising spending in Europe), the COVID-19 pandemic became a significant change driver, elevating opportunity to requirement.

Consumers have been leaning towards their mobile devices for several years. For example, The Guardian newspaper reported that UK online shopping on mobiles had overtaken web in 2014. But while brands have been aware of the mobile opportunity for some time (ads targeting mobile devices have been climbing to the current level of 48 per cent of digital advertising spending in Europe), the COVID-19 pandemic became a significant change driver, elevating opportunity to requirement.

During lockdowns, people resorted to dealing with their banks and insurers and shopping online. In addition, they rediscovered the ease of mobile payment methods like Apple Pay, Samsung Pay and PayPal, making staying on their mobiles long after lockdowns lifted all the more enticing.

A Global Digital Experience Trends 2023 survey of 7,000 consumers worldwide revealed how people feel about digital experiences across countries, industries and devices, including mobile in-app interactions. For example, while the desktop was once the go-to channel for transaction-based experiences, todays consumers are trending towards choosing mobile experiences over larger devices. 51 per cent say they prefer to transact on a mobile than a desktop or laptop – much more in the Netherlands, at 63 per cent.

Consumers are scrapping brand loyalty for great experiences

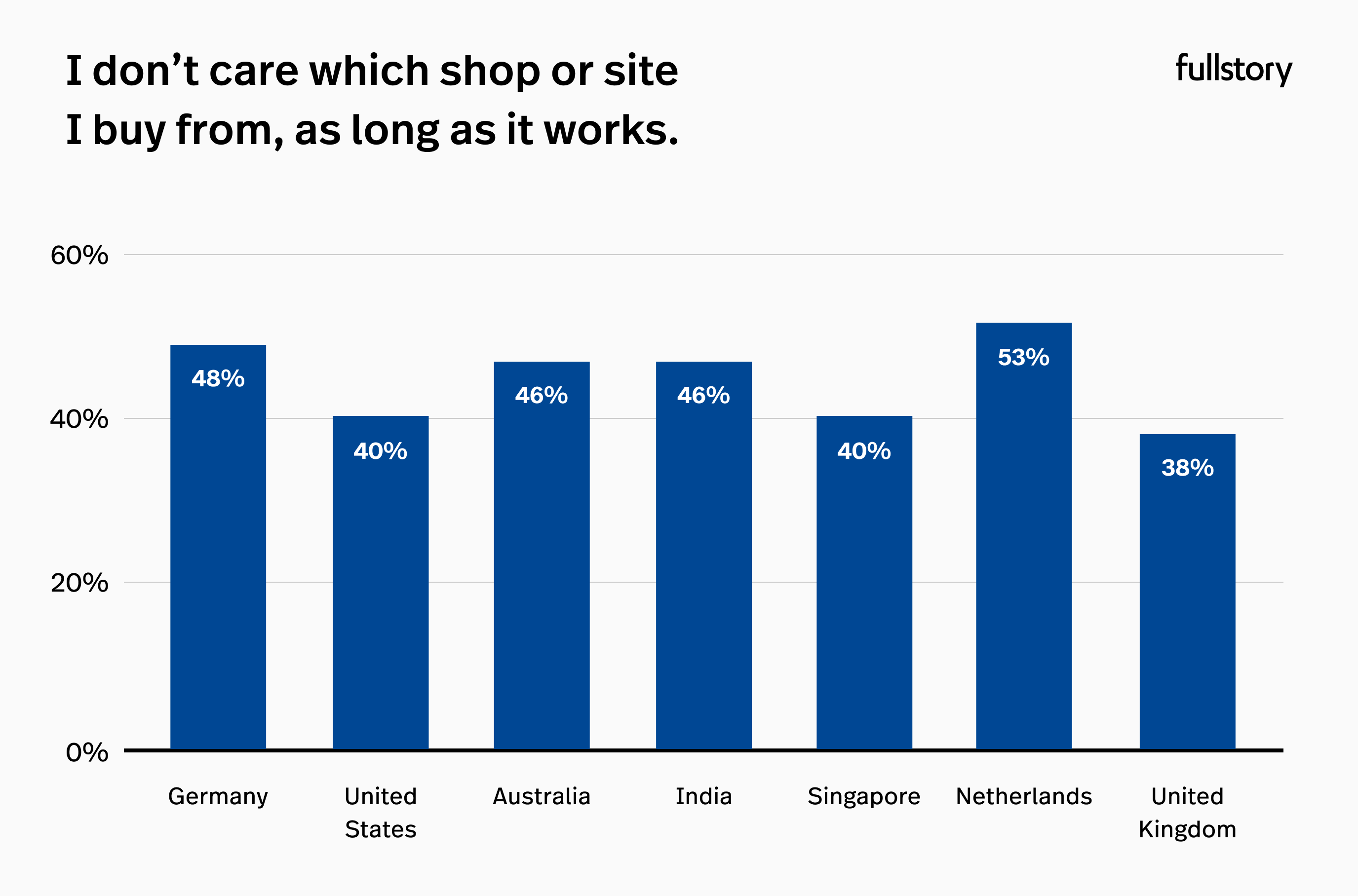

Consumers are quite clear on their new expectations of interacting with brands, including from mobile devices. Where they were once brand loyal, they are now more inclined to seek good digital experiences. 44 per cent claim they “dont care” where they shop “as long as it works.” Thats brilliant news for those who invested time and money in developing apps at the first indication of a mobile-motivated market.

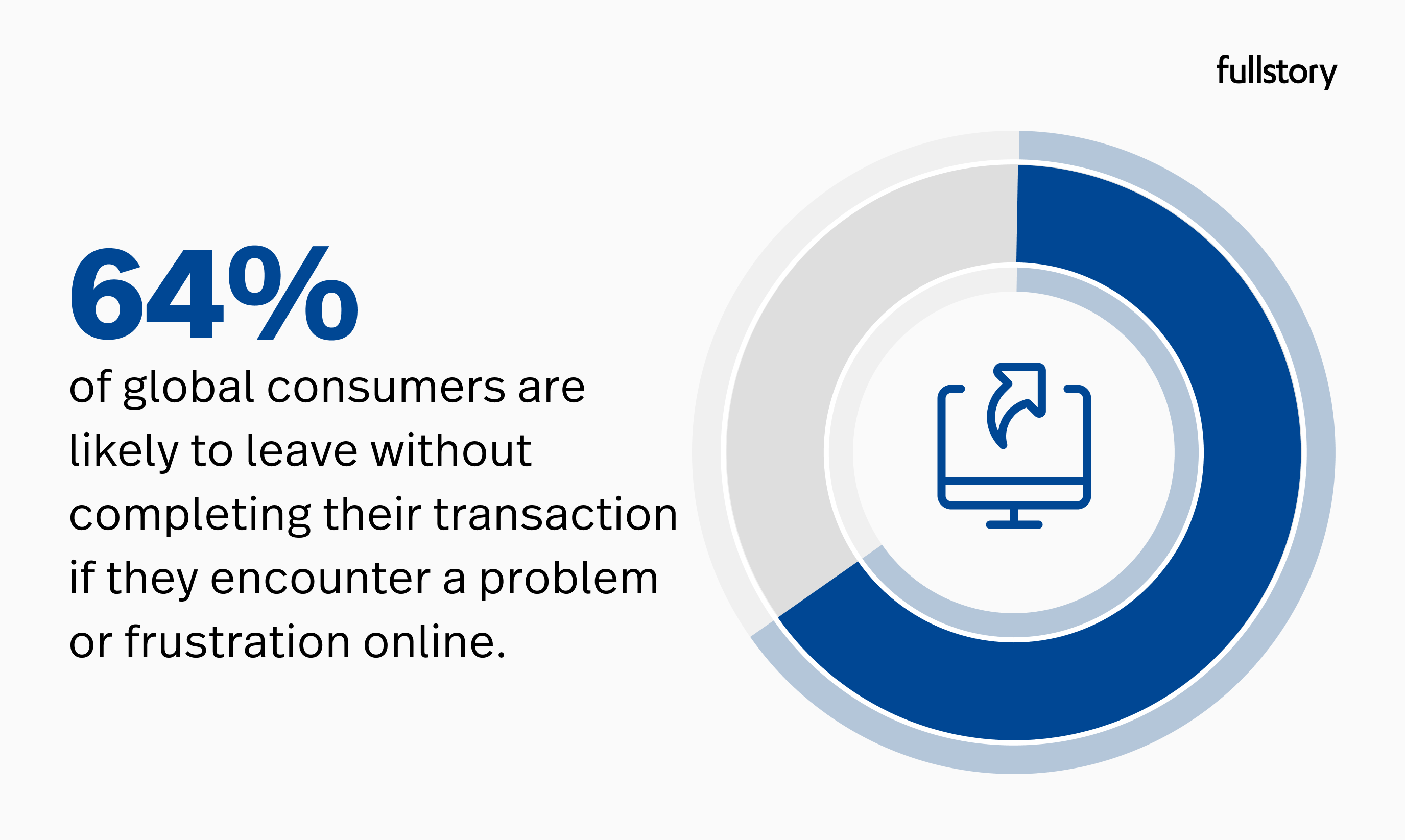

Things could be better for those who left mobile for later, since its highly likely that a disappointing experience on such a vital channel could eradicate any opportunity to interact with the same customer on another channel. We say “likely” because FullStorys data indicates that 43 per cent are silent critics who wont give feedback on why they are walking out the virtual door.

What constitutes an unsatisfactory consumer experience?

Rage clicks or taps, for one. 72 per cent of consumers confess to rage-clicking when a site or app isnt working. Far better to avoid the faulty digital experiences that cause friction in the first place since the action following rage for 65 per cent of consumers is abandonment. In the UK, there is an even lower tolerance for frustration, with 70 per cent saying they will walk away.

Consumers are telling us beyond doubt that experiences matter in an eCommerce world. And mobile experiences must be a priority. In this environment, Digital Experience Intelligence (DXI) is on the rise as a means to avoid the costly pitfalls of getting these experiences wrong.

Brands are turning to data insights to meet consumer demands

Essentially, DXI, being increasingly embraced by online brands, is a way to listen to consumers through how they engage in apps, quickly fixing their frustrations and preempting their needs. Understanding the whole digital experience of millions of events per second saves time and money in creating experiences consumers dont like and allows brands to deliver what they do.

In mobile apps, where creators are often too busy to audit the app experience constantly, but understand there are plenty of places for the UI (user interface) to let them down, DXI spots trends and flags signals for when the mobile experience is broken. These might be signals that consumers find the app hard to navigate, a form isnt taking their data input, or a button refuses to click. Knowing these issues are there, allows brands to fix any design and coding issues before customers disappear to the next provider.

Some are doing better at delivering in-app experiences than others

From a country viewpoint, the Netherlands and the UK have around two-thirds of the consumer vote for positive experiences, with around a third labelling their digital experiences excellent.

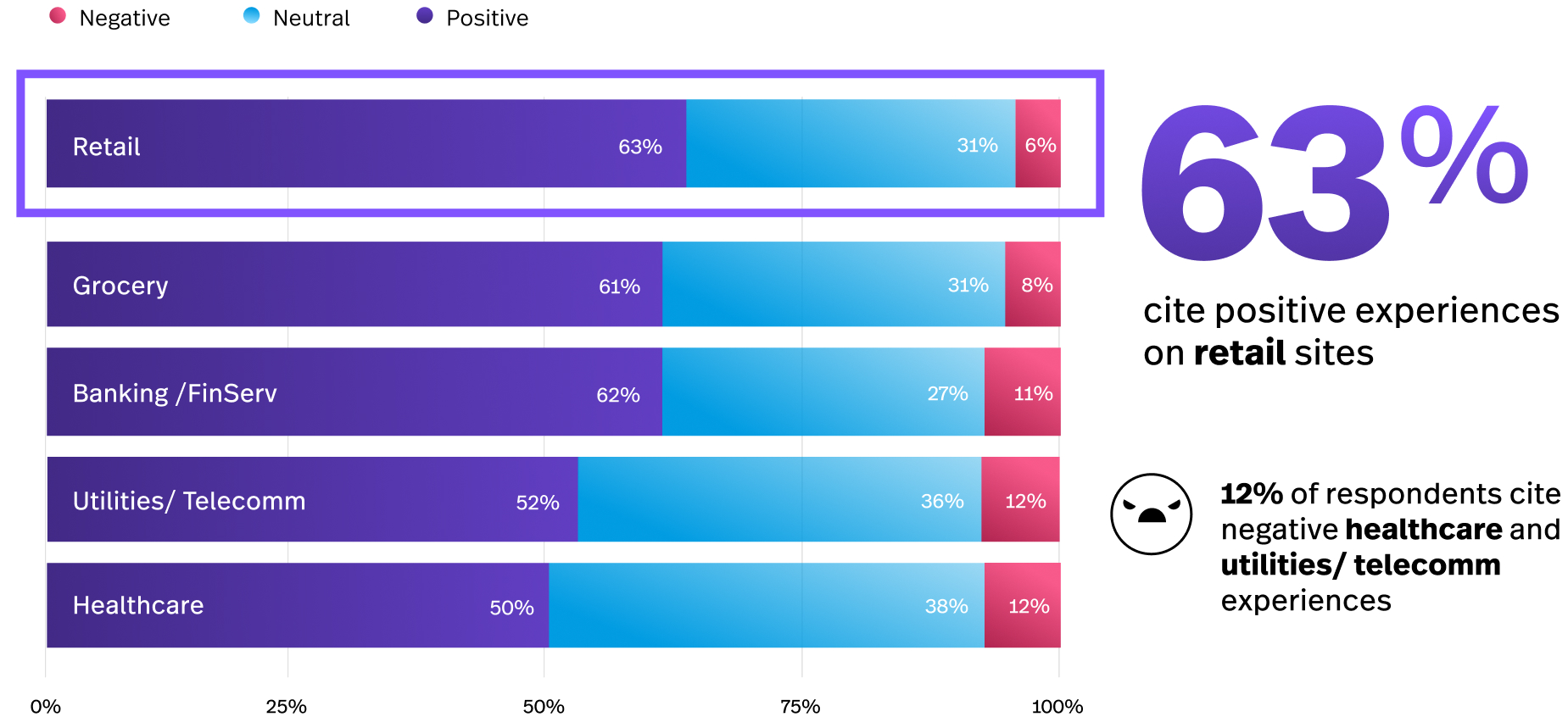

From an industry standpoint, the Retail sector is working hard to improve mobile in-app experiences, with 63 per cent citing positive experiences on a retail site.

While the Retail, Grocery and Finance sectors are leading the way from an industry point of view, Healthcare is facing a significant opportunity to grasp their piece of the in-app pie.

And it’s not all roses for Retail, either. With recent global pressures on the cost of living, 49 per cent of consumers say they are cutting back on online shopping. It’s a similar story for each surveyed country:

And it’s not all roses for Retail, either. With recent global pressures on the cost of living, 49 per cent of consumers say they are cutting back on online shopping. It’s a similar story for each surveyed country:

- Australia: 52 per cent of consumers

- Germany: 52 per cent of consumers

- United Kingdom: 48 per cent of consumers

- United States: 44 per cent of consumers

- The Netherlands: 41 per cent of consumers

So where does that leave us?

Facing the facts about mobile digital experiences

Even with the bumps of a changing global economy or the nuances of mobile culture across industries and geographies, consumers clearly prefer interacting with brands on mobile devices. This means brands cannot afford to overlook the fundamentals consumers seek from mobile apps, which is on par with (not secondary to) what they expect from their browser interactions:

- Seamless experiences

- Value

- An effortless path to purchase

Since consumers say theyre prepared to jump ship for brands that dont deliver all that, often with no explanation, crucial data insights are likely to play a growing role in helping brands satisfy consumers and assure their loyalty.

Get access to the full report here.