Game IQ – the Gold Standard for game analytics and classification

- Wednesday, November 11th, 2020

- Share this article:

The COVID-19 pandemic has hit most industries hard, but one of the few to have thrived over the past few months is mobile gaming. With so many people around the world finding themselves with more time on their hands, there have been huge increases in the number of people playing games on their phones. 20bn games have been downloaded already this year. And a new report from App Annie has revealed where mobile gamers’ time – and money – is being spent.

The COVID-19 pandemic has hit most industries hard, but one of the few to have thrived over the past few months is mobile gaming. With so many people around the world finding themselves with more time on their hands, there have been huge increases in the number of people playing games on their phones. 20bn games have been downloaded already this year. And a new report from App Annie has revealed where mobile gamers’ time – and money – is being spent.

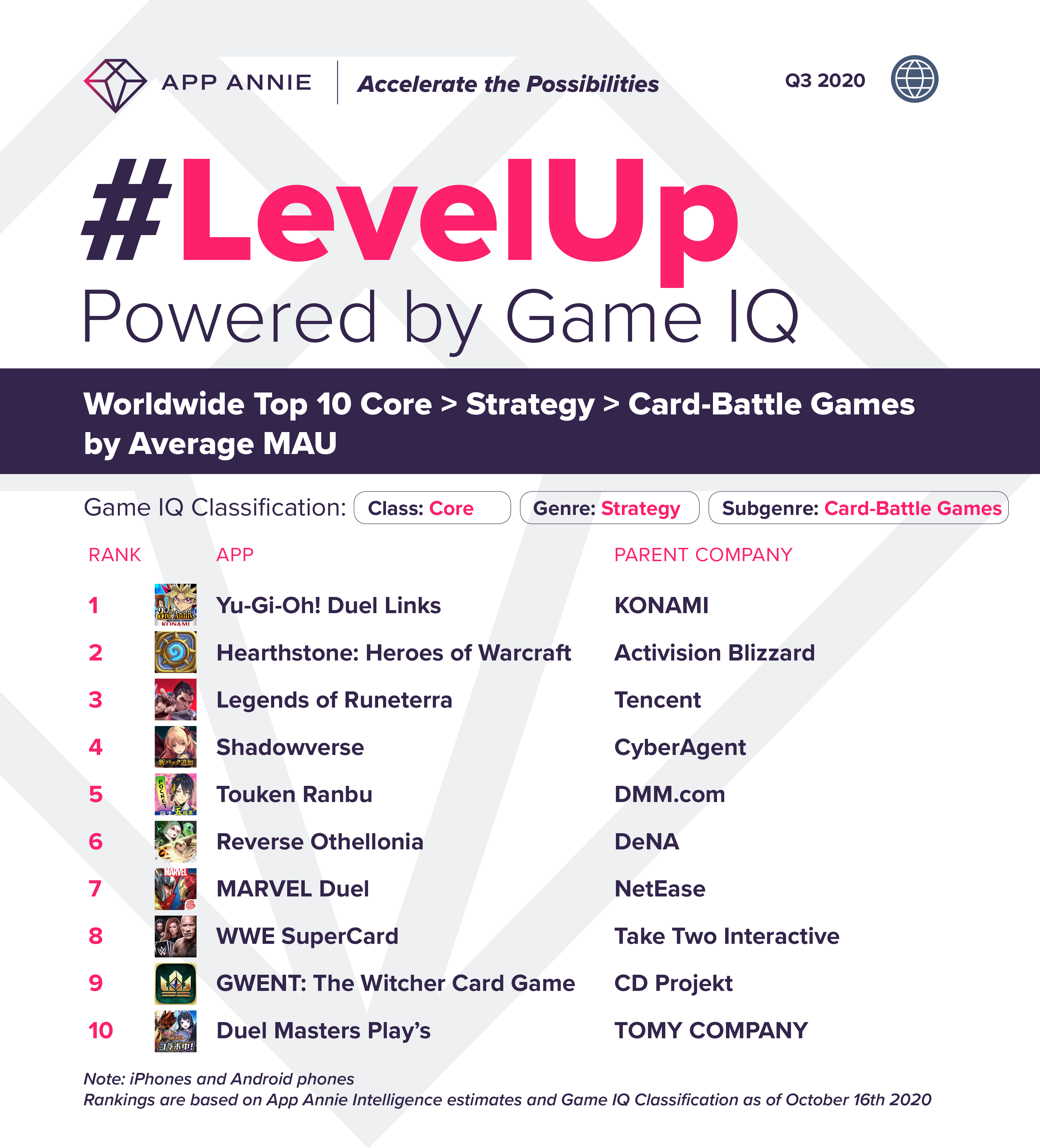

The report reveals that there were 5bn downloads of hyper-casual games in H1 2020. These are typically simple puzzle or word games that anyone can play when they have a few minutes to spare. When it comes to genres, 50 per cent of time spent in the top 1000 games in H1 2020, by monthly average users, came from Core genres. These are typically more difficult games, with longer, less frequent play sessions.

Casino genre games, which typically involve some form of gambling, saw a 40 per cent year-on-year growth in consumer spend in H1 2020. And while Battle Royale games only represented 3 per cent of downloads in this period, they accounted for 20 per cent of the total time spent among top mobile games by monthly average users. Finally, 80 per cent of total consumer spend in Action RPG games such as Cyberpunk and Path of Exile came from APAC markets.

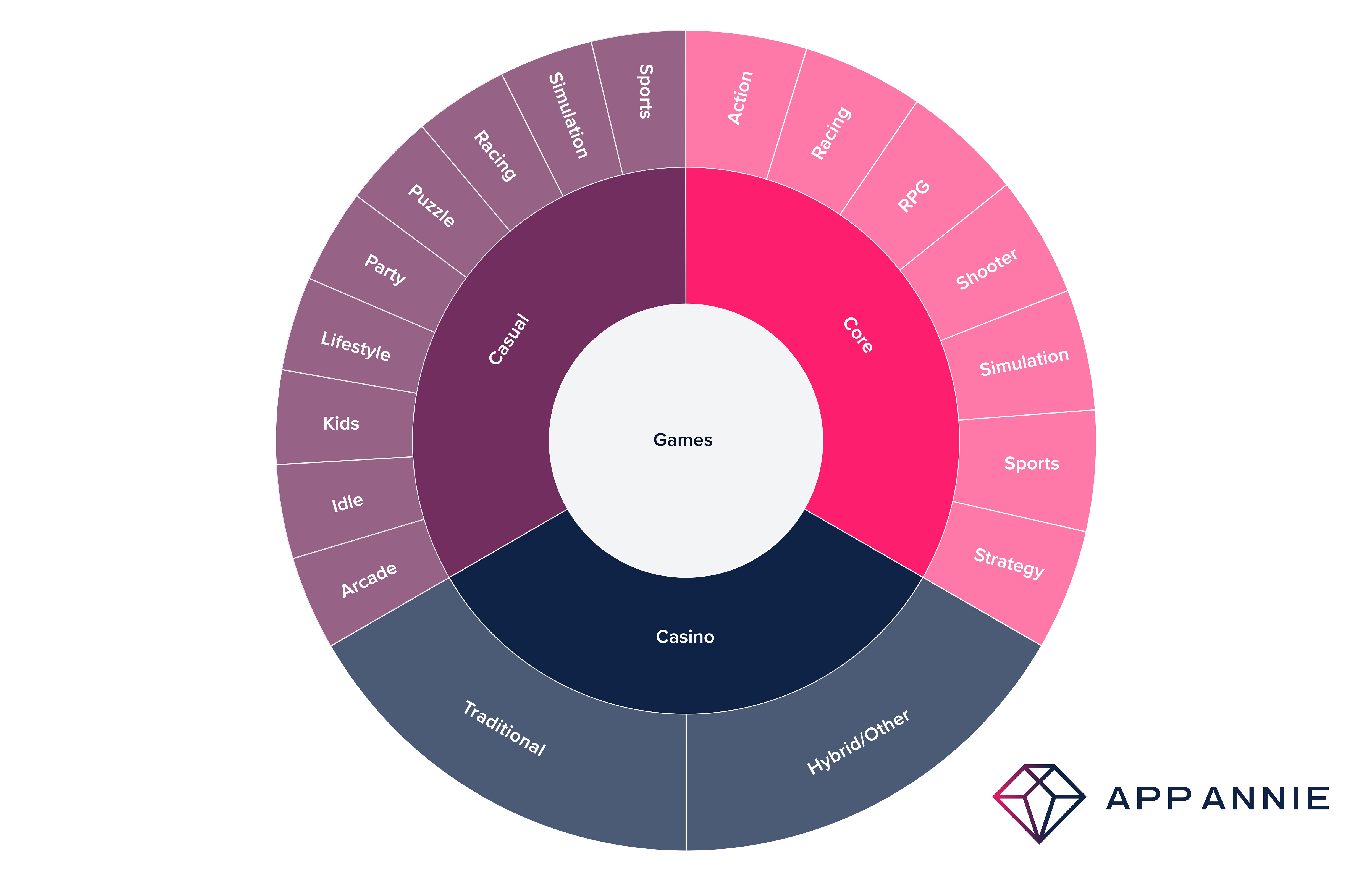

Game categorisation

The numbers come from App Annie’s recently-launched games classification and analytics platform, Game IQ. App Annie created the platform to solve a problem that has been caused by the explosion in mobile game development to satisfy consumer demand. As new games and new types of games are continually released, each game category, such as Casual, houses an ever-increasing number of game types, such as Puzzle, Runner, Word etc, which the app stores struggle to classify with any sort of granularity. To solve the problem, App Annie has analysed and tagged over 30,000 games, which between them account for 97 per cent of global games revenues. The games have been categorised by three criteria: Class; Genre; Subgenre. In addition, App Annie has created 136 tags around the style of gameplay, monetization and other factors, which are applied to each game. Let’s take a closer look at how it works.

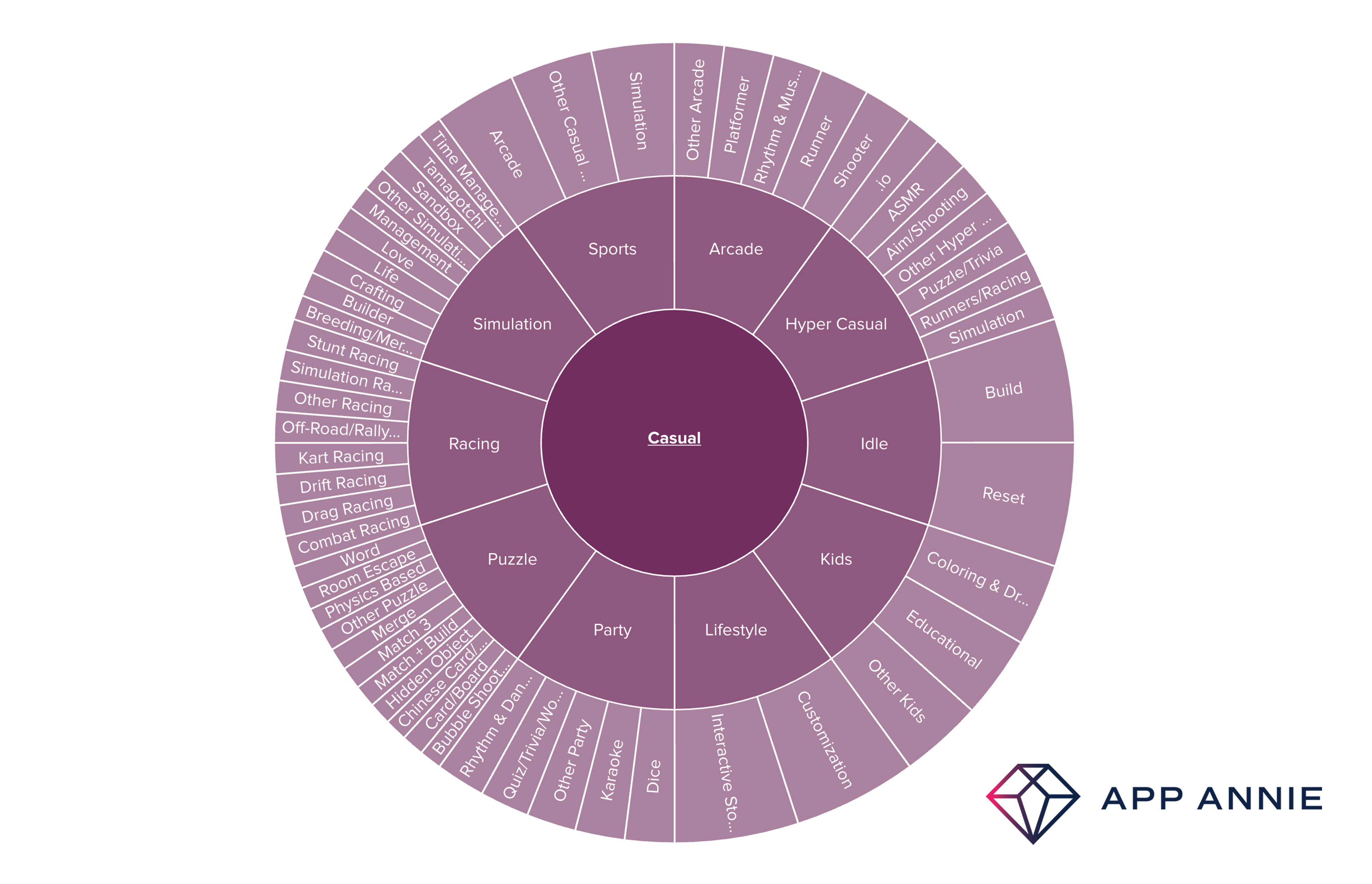

The numbers come from App Annie’s recently-launched games classification and analytics platform, Game IQ. App Annie created the platform to solve a problem that has been caused by the explosion in mobile game development to satisfy consumer demand. As new games and new types of games are continually released, each game category, such as Casual, houses an ever-increasing number of game types, such as Puzzle, Runner, Word etc, which the app stores struggle to classify with any sort of granularity. To solve the problem, App Annie has analysed and tagged over 30,000 games, which between them account for 97 per cent of global games revenues. The games have been categorised by three criteria: Class; Genre; Subgenre. In addition, App Annie has created 136 tags around the style of gameplay, monetization and other factors, which are applied to each game. Let’s take a closer look at how it works.

Class houses three game types: Core, Casino and Casual. For each of these, Game IQ then breaks things down further into the genre of game within each. To see how this works, see the illustration below which shows the breakdown for Casual games. All in all, there are 98 subgenres across the Core, Casino and Casual categories.

Game tags

As a game classification system goes, that’s impressive enough. But Game IQ doesn’t stop there. Each of the 30,000 games analysed to create the platform has been tagged with one of five tags: Game Play, Monetization, Art Style, IP and Theme. Each of these has several specific tags. For Game Play, for example, there are 17, including Multiplayer, Lucky Spin/Scratch and Tournaments. Monetization has eight, including Advertising, Subscription and Power Ups. Art Style has 11, including 2D, 3D, Anime, Cartoony and Pixel/Voxel. For Theme, there are 44 tags, including Detective, Horror, Hunting and several tags for different types of sport. The biggest Tag category is IP, which has 56 tags, including Disney, Marvel, Mario, World Series of Poker and Slam Dunk. You can see the full list of tags here.

Identify trends, spot opportunities

The idea behind this rich, highly granular game classification is to enable games developers to identify trends and spot new opportunities. It enables them to answer questions such as: What are the market opportunities under the different granular categories? Is the game tuned for Core, Casual, or Casino players? Which genre fits the gameplay – RPG, Hyper Casual, etc? What is the core loop of the game – Slots, Match 3 Puzzle, etc? And which subgenres are performing well in different markets?

Using Game IQ, developers can inform their product roadmap based on game play trends, granular market sizing, and competitor strategies. They can discover new regions for user acquisition or global expansion, by understanding regional gameplay trends and market potential. Find new markets by noting the other types of games that their users are playing. And understand how specific features, IPs, and monetization mechanics lead to game success.

A developer may have a game, for example, that monetizes the same way in all countries, but the Game IQ data tells them that if they switch things around in APAC, they could be onto a winner.

Or, a developer may assume that all Casino players look and behave in a similar manner, but the Game IQ data reveals that Poker gamers and Slots gamers are totally different. Poker gamers also play a lot of Word and Puzzle games, while Slots gamers prefer Match 3 games. This presents an opportunity to both develop a new game type the developer may not have considered, or offer some guidance on the right type of game to promote to the Poker and Slots gamer audience.

Perhaps the best way to appreciate the power of the platform is to take a closer look at some of those H1 2020 stats that Game IQ has delivered. It reveals, for example, that mobile gaming is on track to surpass $100bn of revenues in the app stores in 2020, extending its global lead to 2.8x PC/Mac gaming and 3.1x home games consoles.

Casual games accounted for 80 per cent of downloads in the period, showing the demand for simple, on-the-go gaming experiences. Yet despite only accounting for 19 per cent of downloads, Core games were responsible for 51 per cent of the time spent playing, with Action games accounting for 28 per cent of the figure. The top five worldwide breakout games by download are all Hyper-Casual. When it comes to consumer spend on and in games, RPG and Strategy games drove 49 per cent of consumer spend worldwide. For Core games, meanwhile, Gacha/Loot Boxes are the leading monetization method.

Regional preferences

The data also reveals that the majority of Casual games are portrait-oriented with a 2D art style, while most Core games are rendered in 3D in landscape mode. The data also reveals how important it is to understand regional preferences in terms of themes and settings. While Fantasy is the top theme across the Americas, EMEA and APAC, the second choice preference varies significantly by country. In Canada, the UK and France, it’s Home Design, while in Germany and South Korea it’s War, and in the United States, Casino/Gambling. In Japan, meanwhile IP plays a bigger factor in both downloads and consumer spend success.

“Game IQ goes many levels deeper,” says Junde Yu, General Manager, Gaming at App Annie. “Its not just about understanding that, for example, amongst all Core games, Turn-based games have the highest ARPU. It enables users to go beyond this to understand that amongst Turn-based games, most of them monetize via Gacha/Loot boxes, and also have unique IP.”

There’s a whole load more data from the platform that can help games developers make the right decisions. To find out more/get a demo.